Hello I hope everybody had a good Memorial Day and I pay homage to all of the soldiers who fight and die for sustaining a just ideal, no matter what.

Well I'm checking a few more stocks but this ones with bullish potential. They are not the final list because I need to keep running tests to see if they can withstand a market going against them.

HERO TSYS MDCO JBLU MKSI JBL

These, plus the ones that I mentioned the previous post and maybe a few ones are going to be the ones to be checked closely to see how eager to outperform the indexes they are.

By next week I'll have ready both lists one with candidates probably going down and the bullish ones.

I will try to find the stocks among the universe that I study that can "disobey" the general trend as mentioned in previous posts.Of course I'm not claiming that I have solved my long dated problem about individual performance and general trend, but I can see where I'm standing at this point of my research.Will see.

For now will check all the stocks that mentioned during the past month and present a view of the posible outcomes for them.

Good luck

Dan

Tuesday, May 31, 2011

Friday, May 27, 2011

May 28, 2011 Linkfest

Fidel Gheit on Goldman Sachs and Morgan Stanley Manipulating the Oil Market and WikiLeaks: Saudis often warned U.S. about oil speculators vs. Speculator Ghosts in the Oil Machine

China rare earth metals prices soar

Coal, real interest rates and FX

FT: China faces worst drought in 50 years

Goldman warns of significant China slowdown

Small Cap Valuations Getting Extended

Recession Forecasts? Yield Curve Says No Way

Mortgage rates cheap

Corporate profits remain very strong. Hmm, the MMTers might be right...

Salesforce.com: Putting Lipstick on a Pig

The Audacity of Chinese Frauds, Those clever people at China Fire and Security and Bain

Members of Congress Get Abnormally High Returns From Their Stocks

Your Commute Is Killing You

Why the white working class is the most alienated and pessimistic group in American society.

China rare earth metals prices soar

Coal, real interest rates and FX

FT: China faces worst drought in 50 years

Goldman warns of significant China slowdown

Small Cap Valuations Getting Extended

Recession Forecasts? Yield Curve Says No Way

Mortgage rates cheap

Corporate profits remain very strong. Hmm, the MMTers might be right...

Salesforce.com: Putting Lipstick on a Pig

The Audacity of Chinese Frauds, Those clever people at China Fire and Security and Bain

Members of Congress Get Abnormally High Returns From Their Stocks

Your Commute Is Killing You

Why the white working class is the most alienated and pessimistic group in American society.

Labels:

linkfest

Friday Open Thread

And a link - from an article I read yesterday and thought was chock full of wisdom.

Beware of experts bearing predictions

In one of the best-known investigations into the value of expert opinions, University of California psychologist Philip Tetlock solicited predictions from 284 professional economic and political forecasters, asking them to rate the probability of several potential outcomes. Most of the questions had only three possible outcomes, writes Jonah Lehrer, author of 2009’s “How We Decide.” Yet the pundits picked the right answer less than one-third of the time. In other words, writes Lehrer, “A dart-throwing chimp would have beaten the vast majority of professionals.” What’s more, Tetlock found that the most famous pundits tended to be the least accurate, consistently making overblown forecasts. Those with doctorates were no more accurate than those with only undergraduate degrees. Journalists were just as accurate as professors.

The problem, Tetlock concluded, was the certainty of the experts. Experts, especially prominent ones, were so confident in the accuracy of their particular world view that they imposed a “top-down solution on their decision-making process,” writes Lehrer. Instead of weighing the evidence and trusting their gut, the experts disregarded evidence that contradicted their world view.

And finally, some advice toward the end of the article that I thought was worth a mention. Advice I agree with very much, it is one of the the chief reasons I have always reacted to negatively toward people who express too much certitude.

The best pundits realize their predictions might be wrong, so commentators who seem most confident are the most dangerous.

The best pundits realize their predictions might be wrong, so commentators who seem most confident are the most dangerous.

In one of the best-known investigations into the value of expert opinions, University of California psychologist Philip Tetlock solicited predictions from 284 professional economic and political forecasters, asking them to rate the probability of several potential outcomes. Most of the questions had only three possible outcomes, writes Jonah Lehrer, author of 2009’s “How We Decide.” Yet the pundits picked the right answer less than one-third of the time. In other words, writes Lehrer, “A dart-throwing chimp would have beaten the vast majority of professionals.” What’s more, Tetlock found that the most famous pundits tended to be the least accurate, consistently making overblown forecasts. Those with doctorates were no more accurate than those with only undergraduate degrees. Journalists were just as accurate as professors.

The problem, Tetlock concluded, was the certainty of the experts. Experts, especially prominent ones, were so confident in the accuracy of their particular world view that they imposed a “top-down solution on their decision-making process,” writes Lehrer. Instead of weighing the evidence and trusting their gut, the experts disregarded evidence that contradicted their world view.

And finally, some advice toward the end of the article that I thought was worth a mention. Advice I agree with very much, it is one of the the chief reasons I have always reacted to negatively toward people who express too much certitude.

The best pundits realize their predictions might be wrong, so commentators who seem most confident are the most dangerous.

The best pundits realize their predictions might be wrong, so commentators who seem most confident are the most dangerous.

Thursday, May 26, 2011

Thorsday!

A couple of article I came across in my reading this week that I thought would be interesting to share with the group.

The first topic is inflation, specifically, the CPI and how horrible the government has become at reporting accurate and up to date information on economic statistics.

A Billion Prices Now

The government continues to track inflation, for instance, by gathering price data much as it did in the nineteen-fifties: it surveys consumers by phone to see where they buy, surveys businesses to see how much they charge, checks out shopping malls to price goods. This leaves out consumers who have only cell phones, and it probably overstates inflation by not fully accounting for things like the impact of big-box stores. The larger problem, though, is the time it takes: the Consumer Price Index’s figures don’t come out until a month after the fact. In turbulent times, that’s too slow.

which was designed by the M.I.T. economists Alberto Cavallo and Roberto Rigobon, gathers price data not via survey but, rather, by continuously scouring the Web for prices of online goods around the world. (In the U.S., it collects more than half a million prices daily—five times the number that the government looks at.) Using this information, Cavallo and Rigobon have succeeded in building what amounts to the first real-time inflation index. The B.P.P. tells us what’s happening now, not what was happening a month ago. For instance, after Lehman Brothers went under, in September, 2008, the project’s data showed that businesses started cutting prices almost immediately, which suggested that demand had collapsed. The government’s numbers, by contrast, didn’t show this deflationary pressure until that November. This year, there’s been a mild uptick in annual inflation, and again the B.P.P. detected the new trend before the Consumer Price Index did. That kind of early heads-up could help governments make more timely decisions.

This second article is a short one, but lays out a good argument for an upcoming disconnect between oil and equities.

Oil and stockmarkets likely to delink this year

The ending of the second round of quantitative easing (QE2), that has pumped $600 billion (370 billion pounds) in financial markets since last year, will exacerbate the break, fund managers and analysts say, and could mean the asset classes start to move inversely.

"Once QE2 is out of the way, the wave of money that has flowed into commodities will recede and the high correlations between commodities and other asset groups will diminish," said Nicholas Denbow, fund manager at VOC Capital Management.

Share moves have tended to track the sharp swings in oil prices since the last global financial crisis, which saw assets perceived as risky first of all dive, and then recover sharply.

The first topic is inflation, specifically, the CPI and how horrible the government has become at reporting accurate and up to date information on economic statistics.

The government continues to track inflation, for instance, by gathering price data much as it did in the nineteen-fifties: it surveys consumers by phone to see where they buy, surveys businesses to see how much they charge, checks out shopping malls to price goods. This leaves out consumers who have only cell phones, and it probably overstates inflation by not fully accounting for things like the impact of big-box stores. The larger problem, though, is the time it takes: the Consumer Price Index’s figures don’t come out until a month after the fact. In turbulent times, that’s too slow.

which was designed by the M.I.T. economists Alberto Cavallo and Roberto Rigobon, gathers price data not via survey but, rather, by continuously scouring the Web for prices of online goods around the world. (In the U.S., it collects more than half a million prices daily—five times the number that the government looks at.) Using this information, Cavallo and Rigobon have succeeded in building what amounts to the first real-time inflation index. The B.P.P. tells us what’s happening now, not what was happening a month ago. For instance, after Lehman Brothers went under, in September, 2008, the project’s data showed that businesses started cutting prices almost immediately, which suggested that demand had collapsed. The government’s numbers, by contrast, didn’t show this deflationary pressure until that November. This year, there’s been a mild uptick in annual inflation, and again the B.P.P. detected the new trend before the Consumer Price Index did. That kind of early heads-up could help governments make more timely decisions.

This second article is a short one, but lays out a good argument for an upcoming disconnect between oil and equities.

The ending of the second round of quantitative easing (QE2), that has pumped $600 billion (370 billion pounds) in financial markets since last year, will exacerbate the break, fund managers and analysts say, and could mean the asset classes start to move inversely.

"Once QE2 is out of the way, the wave of money that has flowed into commodities will recede and the high correlations between commodities and other asset groups will diminish," said Nicholas Denbow, fund manager at VOC Capital Management.

Share moves have tended to track the sharp swings in oil prices since the last global financial crisis, which saw assets perceived as risky first of all dive, and then recover sharply.

Wednesday, May 25, 2011

IPOs

So much for my Turnaround Tuesday

Anyway, I keep my shorts on. As it were.

This post is about IPOs. I don’t have much to say, but I’d like to point out two IPOs that have had significant publicity, and their performance on the first day of trading.

You can make your own conclusions from the charts. But to make sure I hit you over the head with the sledgehammer, see the breakout after the first few minutes.

Now, in the comment field below, let's see how you anonymouse tradours would trade this.

Have a great day. Go, Bucky!

Anyway, I keep my shorts on. As it were.

This post is about IPOs. I don’t have much to say, but I’d like to point out two IPOs that have had significant publicity, and their performance on the first day of trading.

You can make your own conclusions from the charts. But to make sure I hit you over the head with the sledgehammer, see the breakout after the first few minutes.

Now, in the comment field below, let's see how you anonymouse tradours would trade this.

Have a great day. Go, Bucky!

Tuesday, May 24, 2011

Screening

Hello everybody.

This post is going to be short basically I was doing a lot of work for several months and started separating sometimes one stock performance's from the whole market, a long desired target. Still a lot of work to do but I'm getting there.

Basically mentioning what stocks I'm watching for either side of the trend.

I mentioned already that I'm monitoring APKT, COH probably not, DECK, VRSN, ACTG and TXRH as candidates for a drop if the general market went down back at the end of April. Some dropped some not, and COH was the one that went up so that's why I still watch it but with less enthusiasm.

VRSN is becoming after almost a month more of a wild card, up or down now so I want to studied it further because could generate a very strong move and I want to get it more clear the timing.

And on the long side I'm watching HAS, BANR, TSYS, NPSP PLXT besides following the ones that I mentioned a long ago like ACAS, EZPW or BSX and some other that maybe will pass the screen test by next week.

I don't have wrapped up both groups yet this is just following them to see what are they doing and how correlated their movements are with the main trend (or lack thereof).

So by next week I'll probably have some candidates that regardless what the main trend do have a good potential to do it's own stuff; all this of course in a normal kind of market (not explosive but really explosive upward move or rapture's time for equity markets). Just a market that acts like it does 90% of the time.

Good luck

Dan

This post is going to be short basically I was doing a lot of work for several months and started separating sometimes one stock performance's from the whole market, a long desired target. Still a lot of work to do but I'm getting there.

Basically mentioning what stocks I'm watching for either side of the trend.

I mentioned already that I'm monitoring APKT, COH probably not, DECK, VRSN, ACTG and TXRH as candidates for a drop if the general market went down back at the end of April. Some dropped some not, and COH was the one that went up so that's why I still watch it but with less enthusiasm.

VRSN is becoming after almost a month more of a wild card, up or down now so I want to studied it further because could generate a very strong move and I want to get it more clear the timing.

And on the long side I'm watching HAS, BANR, TSYS, NPSP PLXT besides following the ones that I mentioned a long ago like ACAS, EZPW or BSX and some other that maybe will pass the screen test by next week.

I don't have wrapped up both groups yet this is just following them to see what are they doing and how correlated their movements are with the main trend (or lack thereof).

So by next week I'll probably have some candidates that regardless what the main trend do have a good potential to do it's own stuff; all this of course in a normal kind of market (not explosive but really explosive upward move or rapture's time for equity markets). Just a market that acts like it does 90% of the time.

Good luck

Dan

Monday, May 23, 2011

Manny Mondays: Elephants & Canaries Wild Life Edition

Morning all! Because I was forced to cancel my gold tee time due to a stormy afternoon, I spent much of the afternoon getting caught up on current events. As I sit here pondering the next move for both the markets and our so-called economic "recovery", a couple of thoughts and related posts stood out for me as the real "elephants in the room" or "canary(ies) in the coalmine" for me, and ones that are likely to rear their ugly heads in some meaningful fashion if not this year, then during next year's election circus year and possibly beyond:

(1) The "99ers" and the long-term unemployed

(2) The continued weak and ever-declining housing market

In my afternoon reading, I came across a couple of really illimunating posts on these topics stood out for me as ones that should at least give us pause on the true legitimacy and life span of our so-called "economic recovery". What happens when unemployment benefits, retirement accounts and other savings run dry for more of these people? What happens when more and more people who are vastly underwater on primary and multiple homes decide to walk away from a depreciating asset that is quickly becoming more of a liability? I believe that our fearless leaders ignore or dimiss these issues at their (and our) peril.

Here is the first one:

99ers and the Long-term Unemployed Are the Elephants in the Economic Recovery Room

There are several startling facts in the article but a few key excerpts stuck out for me:

The job market is admittedly improving for some, but it’s not improving quickly enough for millions of jobless, especially the long-term unemployed. In April, the ranks of the unemployed who have been out of work for 99 weeks or more increased by 21,000 to a record 1,920,000. That equates to 14.5% of all unemployed.

Other long-term unemployed fared a little better in April compared to March. Those out of work for 26 weeks or more decreased from 5.839 million from 6.122 million in March. But their percentage of the overall unemployment rate remained elevated at a near record level of 43.2%. The percentage of those out of work for more and 52 weeks increased from 31.5% to 32.8% of all unemployed.

What is being done legislatively to address this elephant in the room? To date, nothing. The GOP controlled House has been busy attempting to cut the deficit, repealing healthcare funding, and restarting offshore oil drilling. The Republicans, with the help of some Democrats, are working to weaken Wall Street regulation legislation, end net neutrality, and are arguing the Defense of Marriage Act. They are pandering to their base, acquiescing to their corporate overlords and obliging their big-wallet campaign contributors.

Congressional leaders are more concerned with ideology than reality. They have not presented a jobs bill or employment training legislation, conducted investigations on how to solve long-term unemployment, or offered tax incentives for companies to hire the long-term unemployed. They have ignored legislation, such as Rep. Barbara Lee’s H.R. 589, that would help millions of long-term unemployed, the 99ers, who have exhausted all unemployment benefits. While most of the blame can be placed at the door of the GOP controlled House, the Democratic controlled Senate and Obama have been suspiciously silent about the long-term unemployment problem.

The second one appeared last last week over at BR's The Big Picture blog where he cites 20 Startling Facts About the US Housing Market courtesy of Zillow, the Mortgage Bankers Association and other relevant sources.

All of these points are indeed startling but the last five were maybe the most jarring for me to read:

15. According to the Mortgage Bankers Association, at least 8 million Americans are currently at least one month behind on their mortgage payments.

16. In September 2008, 33% of Americans knew someone who had been foreclosed upon or who was facing the threat of foreclosure. Today that number has risen to 48 percent.

17. During the first quarter of 2011, less new homes were sold in the U.S. than in any three month period ever recorded.

18According to a recent census report, 13% of all homes in the United States are currently sitting empty.

19. In 1996, 89% of Americans believed that it was better to own a home than to rent one. Today that number has fallen to 63 percent.

20. According to Zillow, the United States has been in a “housing recession” for 57 straight months without an end in sight.

(1) The "99ers" and the long-term unemployed

(2) The continued weak and ever-declining housing market

In my afternoon reading, I came across a couple of really illimunating posts on these topics stood out for me as ones that should at least give us pause on the true legitimacy and life span of our so-called "economic recovery". What happens when unemployment benefits, retirement accounts and other savings run dry for more of these people? What happens when more and more people who are vastly underwater on primary and multiple homes decide to walk away from a depreciating asset that is quickly becoming more of a liability? I believe that our fearless leaders ignore or dimiss these issues at their (and our) peril.

Here is the first one:

99ers and the Long-term Unemployed Are the Elephants in the Economic Recovery Room

There are several startling facts in the article but a few key excerpts stuck out for me:

The job market is admittedly improving for some, but it’s not improving quickly enough for millions of jobless, especially the long-term unemployed. In April, the ranks of the unemployed who have been out of work for 99 weeks or more increased by 21,000 to a record 1,920,000. That equates to 14.5% of all unemployed.

Other long-term unemployed fared a little better in April compared to March. Those out of work for 26 weeks or more decreased from 5.839 million from 6.122 million in March. But their percentage of the overall unemployment rate remained elevated at a near record level of 43.2%. The percentage of those out of work for more and 52 weeks increased from 31.5% to 32.8% of all unemployed.

What is being done legislatively to address this elephant in the room? To date, nothing. The GOP controlled House has been busy attempting to cut the deficit, repealing healthcare funding, and restarting offshore oil drilling. The Republicans, with the help of some Democrats, are working to weaken Wall Street regulation legislation, end net neutrality, and are arguing the Defense of Marriage Act. They are pandering to their base, acquiescing to their corporate overlords and obliging their big-wallet campaign contributors.

Congressional leaders are more concerned with ideology than reality. They have not presented a jobs bill or employment training legislation, conducted investigations on how to solve long-term unemployment, or offered tax incentives for companies to hire the long-term unemployed. They have ignored legislation, such as Rep. Barbara Lee’s H.R. 589, that would help millions of long-term unemployed, the 99ers, who have exhausted all unemployment benefits. While most of the blame can be placed at the door of the GOP controlled House, the Democratic controlled Senate and Obama have been suspiciously silent about the long-term unemployment problem.

The second one appeared last last week over at BR's The Big Picture blog where he cites 20 Startling Facts About the US Housing Market courtesy of Zillow, the Mortgage Bankers Association and other relevant sources.

All of these points are indeed startling but the last five were maybe the most jarring for me to read:

15. According to the Mortgage Bankers Association, at least 8 million Americans are currently at least one month behind on their mortgage payments.

16. In September 2008, 33% of Americans knew someone who had been foreclosed upon or who was facing the threat of foreclosure. Today that number has risen to 48 percent.

17. During the first quarter of 2011, less new homes were sold in the U.S. than in any three month period ever recorded.

18According to a recent census report, 13% of all homes in the United States are currently sitting empty.

19. In 1996, 89% of Americans believed that it was better to own a home than to rent one. Today that number has fallen to 63 percent.

20. According to Zillow, the United States has been in a “housing recession” for 57 straight months without an end in sight.

Saturday, May 21, 2011

May 21, 2011 Linkfest

The Electricity Drought in China

Asia overheating

The S&P 500 and the Yen Carry Trade

Pettis: Is it time for the US to disengage the world from the dollar?, Rebalancing through wage increases

China Losing Competitiveness

Carlos Slim and Silver, Soros Sells Gold ETPs as Paulson Keeps Bet on Holding the Metal

Benmosche 9% Yield Hunt May Mean AIG Got Junk, Mortgage Bonds. Bailout #N coming up.

Comparing REIT Yields With the S&P 500

Should the Fed be worried about wage inflation?

Court: No resisting unlawful police entry

The Airplane That Saved the World

Asia overheating

The S&P 500 and the Yen Carry Trade

Pettis: Is it time for the US to disengage the world from the dollar?, Rebalancing through wage increases

China Losing Competitiveness

Carlos Slim and Silver, Soros Sells Gold ETPs as Paulson Keeps Bet on Holding the Metal

Benmosche 9% Yield Hunt May Mean AIG Got Junk, Mortgage Bonds. Bailout #N coming up.

Comparing REIT Yields With the S&P 500

Should the Fed be worried about wage inflation?

Court: No resisting unlawful police entry

The Airplane That Saved the World

Labels:

linkfest

Friday, May 20, 2011

Thursday, May 19, 2011

Thorsday Open Thread

Plus a nice little article on Apple's share of the mobile phone market. Note, this is the important share of the mobile phone market, the one that matters. Profits.

Apple's Share of Mobile Phone Industry Profits Pushes Toward 60%

Asymco yesterday published a pair of charts providing an interesting perspective on mobile phone company performance for the first quarter of 2011, comparing units sold against profitability.

In the first view, the eight largest mobile phone brands are depicted according to share of units sold during the quarter, with Apple (shown in dark orange) checking in at about 7% share among those top vendors. Apple is joined by Research in Motion and HTC in a category of "smartphone-only" vendors that were responsible for 16% of the overall units shipped during the quarter by the top vendors.

But in looking at the profitability of those top eight vendors, a very different view emerges with Apple accounting for about 57% of total profits and Research in Motion and HTC pitching in to give the smartphone-only vendors over 75% of the total profits among the top vendors. In addition, three of the five "diversified" vendors (LG, Motorola, and Sony Ericsson) drop out of the picture entirely in the new view as they were each unable to turn a profit on their mobile phone businesses during the quarter.

Apple's Share of Mobile Phone Industry Profits Pushes Toward 60%

Asymco yesterday published a pair of charts providing an interesting perspective on mobile phone company performance for the first quarter of 2011, comparing units sold against profitability.

In the first view, the eight largest mobile phone brands are depicted according to share of units sold during the quarter, with Apple (shown in dark orange) checking in at about 7% share among those top vendors. Apple is joined by Research in Motion and HTC in a category of "smartphone-only" vendors that were responsible for 16% of the overall units shipped during the quarter by the top vendors.

But in looking at the profitability of those top eight vendors, a very different view emerges with Apple accounting for about 57% of total profits and Research in Motion and HTC pitching in to give the smartphone-only vendors over 75% of the total profits among the top vendors. In addition, three of the five "diversified" vendors (LG, Motorola, and Sony Ericsson) drop out of the picture entirely in the new view as they were each unable to turn a profit on their mobile phone businesses during the quarter.

Wednesday, May 18, 2011

Death of the PC Companies

Well, for sure, when I started out my career, I never thought I’d be writing this.

About 18 years ago, maybe a little more, after compiling a report on industry trends, I informed my company that we needed to change the business direction, because it was clear from the long term technical integration trend report that the phone would take over most of the PC market.

It was obvious that as soon as we got a decent processor, compact memory systems, and graphics processors were shrunk to the point of living inside a phone and playing back movies, with an interface connector small enough to get the movies to a big screen somewhere, we would have a phone that would do it all.

We have that phone almost. If AAPL would ever choose a processor that’s good enough and solve the battery life problem, and maybe with more gas stations (gas station being a display kiosk with a keyboard and charger for your iPhone), we would have a solution to my prediction of the future.

Once we get a good phone, what happens to the PC? We’ve already seen the market swing away from an unwieldy form factor notebook to a tablet which lets the user surf the net, and be a “shopping buddy”. Those are the biggest (non-office) usage models for PCs

The PC has evolved into a professional device that a business user can carry around, and an office device which provides local solutions requiring high-resolution display and compute-intensive applications. As we get more “cloud”, that device will be able to evolve down into the tablet market. There’s 3 technical issues that need solutions before this evolution will be complete:

1. Guaranteed bandwidth wherever you are located

2. Complete and absolute security

3. Guaranteed cloud storage space and processing power.

Also there needs to be a paradigm switch for applications where they anticipate keystrokes or mouse clicks and have those predictive answers ready—right now all apps are built backwards, waiting for the keystroke or mouse click before they take direction).

Once you get those three things, all you need to carry with you is your Good Phone and a keyboard. No more need for a notebook. Once you get those three things, you will only need a very small docking station in your office, kind of like the gas station I already mentioned.

So what does that mean to companies like HP whose infrastructure is set up to handle bass-ackwards apps and clumsy heavy hardware for corporations? I think HP’s demise will be shown to be caused by Carly, the great HP/Compaq integrator. HP reminds me of the Argentinosaurus. Looks like the Cretaceous Extinction is fast approaching them.

HP is beginning to feel the pain. Dell is not far behind. Unless Intel gets its act together, they are absolute toast (most of it caused by my old pal, Craig Barrett).

By contrast, take a look at IBM: They are incredibly smart, moving out of the PC industry completely.

There will still be a small need for the desktop PC. There will always be gamers wanting the ultimate video interface theater-game like they get at the arcade. But that market is shrinking (did you see nVidia’s future sales projections? ICan must have had a crystal ball, for sure). There will always be some application that solves a niche problem that won’t be ported to the cloud. But for those few cases, there will be Thors who will go around, buying motherboards and chassis and P/S, and integrating those for companies, developing corporate-specific hotloads. (The first thing a corporation who buys PCs does is throw-away the on-board hotload).

What happens to the PC companies? They develop servers, and raids, and matrix-memory solutions for cloud installations. Their market shrinks like a $5 sweater.

How do we trade this?

Short Dell. Short HP.

Long memory producers, including IBM

Long Cloud-software producers, like VMW

By the way, you don’t think that was an accident, IBM getting out of the PC and developing the 3-D memory element, do you? (If you’re techno-interested about the 3d memory, you can read this article.)

http://www.sciencedaily.com/releases/2007/04/070412132140.htm

(See I’m learning not to put the period after the link).

About 18 years ago, maybe a little more, after compiling a report on industry trends, I informed my company that we needed to change the business direction, because it was clear from the long term technical integration trend report that the phone would take over most of the PC market.

It was obvious that as soon as we got a decent processor, compact memory systems, and graphics processors were shrunk to the point of living inside a phone and playing back movies, with an interface connector small enough to get the movies to a big screen somewhere, we would have a phone that would do it all.

We have that phone almost. If AAPL would ever choose a processor that’s good enough and solve the battery life problem, and maybe with more gas stations (gas station being a display kiosk with a keyboard and charger for your iPhone), we would have a solution to my prediction of the future.

Once we get a good phone, what happens to the PC? We’ve already seen the market swing away from an unwieldy form factor notebook to a tablet which lets the user surf the net, and be a “shopping buddy”. Those are the biggest (non-office) usage models for PCs

The PC has evolved into a professional device that a business user can carry around, and an office device which provides local solutions requiring high-resolution display and compute-intensive applications. As we get more “cloud”, that device will be able to evolve down into the tablet market. There’s 3 technical issues that need solutions before this evolution will be complete:

1. Guaranteed bandwidth wherever you are located

2. Complete and absolute security

3. Guaranteed cloud storage space and processing power.

Also there needs to be a paradigm switch for applications where they anticipate keystrokes or mouse clicks and have those predictive answers ready—right now all apps are built backwards, waiting for the keystroke or mouse click before they take direction).

Once you get those three things, all you need to carry with you is your Good Phone and a keyboard. No more need for a notebook. Once you get those three things, you will only need a very small docking station in your office, kind of like the gas station I already mentioned.

So what does that mean to companies like HP whose infrastructure is set up to handle bass-ackwards apps and clumsy heavy hardware for corporations? I think HP’s demise will be shown to be caused by Carly, the great HP/Compaq integrator. HP reminds me of the Argentinosaurus. Looks like the Cretaceous Extinction is fast approaching them.

HP is beginning to feel the pain. Dell is not far behind. Unless Intel gets its act together, they are absolute toast (most of it caused by my old pal, Craig Barrett).

By contrast, take a look at IBM: They are incredibly smart, moving out of the PC industry completely.

There will still be a small need for the desktop PC. There will always be gamers wanting the ultimate video interface theater-game like they get at the arcade. But that market is shrinking (did you see nVidia’s future sales projections? ICan must have had a crystal ball, for sure). There will always be some application that solves a niche problem that won’t be ported to the cloud. But for those few cases, there will be Thors who will go around, buying motherboards and chassis and P/S, and integrating those for companies, developing corporate-specific hotloads. (The first thing a corporation who buys PCs does is throw-away the on-board hotload).

What happens to the PC companies? They develop servers, and raids, and matrix-memory solutions for cloud installations. Their market shrinks like a $5 sweater.

How do we trade this?

Short Dell. Short HP.

Long memory producers, including IBM

Long Cloud-software producers, like VMW

By the way, you don’t think that was an accident, IBM getting out of the PC and developing the 3-D memory element, do you? (If you’re techno-interested about the 3d memory, you can read this article.)

http://www.sciencedaily.com/releases/2007/04/070412132140.htm

(See I’m learning not to put the period after the link).

Tuesday, May 17, 2011

The agony continues

Hello everybody

The equity market continues their going nowhere really fast and I remember several weeks ago when talking about the conditions for a top to be set.

I mentioned people hugging each other in the streets, and I remember when the news of bin Laden being killed broke and all that photographs in the news.

Of course all that celebrations got me thinking that Sunday: could it be?...people are celebrating in the streets. I know, I know is not directly related with the false perception of a turnaround in the economy but at least they are celebrating on the streets anyways; so just the same final result, even though for an entirely different set of reasons.Could that be considered sufficient cause?.

It got me thinking: same final outcome but for unrelated reasons.Can have the same effect from a sentiment point of view in people's mind? (as if the news was related to the economy).

I doubt it strongly, but hey...all the celebrations and inmediately after that a top that lasted two weeks already have me wondering too if it's just big fish using the general public perception alone to play the unexpected card, withouth regard for how much correlated the logic under their moves are.

Of course all this moronic assumptions are entertained in my head when I'm just filling the gas tank or waiting at the supermarket's queue because I don't have too many options.

Still my preferred way to see things is through astrology.Is a lot cleaner and in this case don't need to fill gaps with some kind of defficient logic, just a climax is reached for whatever reason.That's why I prefer astrology anyday.

It's like a theater's play.People playing their roles according to some unknown script and being instrumental to the most probable final outcome.

Like for instance when the knowledgeable guy Mr Strong died (Federal Reserve in the late 20's) not saying he was a good guy just that he kept all that thing going on until he got sick and then died. Incompetence got a big bust afterwards.

Could the IMF's head demise be seen as a tipping point, if bigger problems are triggered for Europe in the near future, like Mr Strong death in the 20's was for America?

In my view, absolutely.They can looked like a small drop in a bucket but what made their roles salient for a future historian is the role they play at a very very precise moment in history, in order to get the ensuing result.

So timming is at least as important as incompetence around the decisions level for something bad to occur.

For that timming thing I choose astrology.

So they can not escape the timming design of things, they just play a role that they can not alter in a meaningful way (obtaining the opposite result of what is expected to be the likeliest result) and my secret view is that they barely have a clue of the role they are eagerly playing.

Regarding Rock asking or wondering to what I paid attention when I was talking about DECK past week is the same thing, for me just astrology.

Not that I don't pay attention to anything else.Of course I chequed free cash flow, debt, price-sales, and if I remember it revenue growth, and short float.

But the thing is, DECK is really, truly the most marvelous thing after sliced bread, seriously.It was at 0.85 cents by late 2002 and before I mentioned it in April reached almost $100.

Studying it is almost like poetry, in my geek view of the world.

So I got a great deal of respect for those companies. EZPW was 0.30 cents and now is at 30 bucks.

They just doubled AAPL performance, in less than a decade. And AAPL wasn't exactly shabby.

So is a lot more challenging trying to get a nice drop in one of this monsters than in a regular stock and a lot less expected by the general public.

If they act according to what I expect for example it tells me that maybe they are getting weaker and who knows, maybe they could be hinting an ending of an impressive rally or at least an unexpected correction. That's why I check them focusing on the downside.

For getting focused on the upside I personally prefer to watch 4-6 bucks stocks. Still don't have the time and means to get focused on the 0.40-0.80 cents that can run a nice decade.Step by step.

Dan

The equity market continues their going nowhere really fast and I remember several weeks ago when talking about the conditions for a top to be set.

I mentioned people hugging each other in the streets, and I remember when the news of bin Laden being killed broke and all that photographs in the news.

Of course all that celebrations got me thinking that Sunday: could it be?...people are celebrating in the streets. I know, I know is not directly related with the false perception of a turnaround in the economy but at least they are celebrating on the streets anyways; so just the same final result, even though for an entirely different set of reasons.Could that be considered sufficient cause?.

It got me thinking: same final outcome but for unrelated reasons.Can have the same effect from a sentiment point of view in people's mind? (as if the news was related to the economy).

I doubt it strongly, but hey...all the celebrations and inmediately after that a top that lasted two weeks already have me wondering too if it's just big fish using the general public perception alone to play the unexpected card, withouth regard for how much correlated the logic under their moves are.

Of course all this moronic assumptions are entertained in my head when I'm just filling the gas tank or waiting at the supermarket's queue because I don't have too many options.

Still my preferred way to see things is through astrology.Is a lot cleaner and in this case don't need to fill gaps with some kind of defficient logic, just a climax is reached for whatever reason.That's why I prefer astrology anyday.

It's like a theater's play.People playing their roles according to some unknown script and being instrumental to the most probable final outcome.

Like for instance when the knowledgeable guy Mr Strong died (Federal Reserve in the late 20's) not saying he was a good guy just that he kept all that thing going on until he got sick and then died. Incompetence got a big bust afterwards.

Could the IMF's head demise be seen as a tipping point, if bigger problems are triggered for Europe in the near future, like Mr Strong death in the 20's was for America?

In my view, absolutely.They can looked like a small drop in a bucket but what made their roles salient for a future historian is the role they play at a very very precise moment in history, in order to get the ensuing result.

So timming is at least as important as incompetence around the decisions level for something bad to occur.

For that timming thing I choose astrology.

So they can not escape the timming design of things, they just play a role that they can not alter in a meaningful way (obtaining the opposite result of what is expected to be the likeliest result) and my secret view is that they barely have a clue of the role they are eagerly playing.

Regarding Rock asking or wondering to what I paid attention when I was talking about DECK past week is the same thing, for me just astrology.

Not that I don't pay attention to anything else.Of course I chequed free cash flow, debt, price-sales, and if I remember it revenue growth, and short float.

But the thing is, DECK is really, truly the most marvelous thing after sliced bread, seriously.It was at 0.85 cents by late 2002 and before I mentioned it in April reached almost $100.

Studying it is almost like poetry, in my geek view of the world.

So I got a great deal of respect for those companies. EZPW was 0.30 cents and now is at 30 bucks.

They just doubled AAPL performance, in less than a decade. And AAPL wasn't exactly shabby.

So is a lot more challenging trying to get a nice drop in one of this monsters than in a regular stock and a lot less expected by the general public.

If they act according to what I expect for example it tells me that maybe they are getting weaker and who knows, maybe they could be hinting an ending of an impressive rally or at least an unexpected correction. That's why I check them focusing on the downside.

For getting focused on the upside I personally prefer to watch 4-6 bucks stocks. Still don't have the time and means to get focused on the 0.40-0.80 cents that can run a nice decade.Step by step.

Dan

Monday, May 16, 2011

Manny Mondays: Century Ride, Turned Mudder 80 Open Thread

Morning all! Due to being tied up all weekend attempting to finish my first "Century" bike ride, the Almanzo 100, and its aftermath, I've been out of blogging commission all weekend so the "floor" is yours today.

How did the ride itself go you, ask? Well, I'll just leave you with a few pictures to give you sense, but let's just say the weather conditions (a raw, low 40's, driving, hellacious wind & rain and riding on mostly dirt and gravel and very, hilly, roads turned to mud) were less than ideal for such an endeavor.

So, I'll fess up that I fell about 20 miles short of finishing the full 100, finally bagging it with my buddy after about 80 miles (and piles of caked, clay-like mud all over us and our bikes) under our belts. Not finishing was initially a pretty big disappointment for me, considering how much I trained for, and looked forward to, the event, but I didn't feel quite so bad when I realized that many cyclists far more experienced than I bagged quite a bit earlier than we did, some at mile 30-40 or so at the first checkpoint. I'd be surprised if even half of the field of 700 or so finished, the conditions were truly that hellacious. The most unfortunate thing was not getting any pictures of the course and surrounding scenery itself (due to the horrendous weather), which was just gorgeous. Lots of scenic (and VERY green) rolling hills, alternating from woods and streams to open prairie and farmland. Very pretty.

Ah, gotta love "springtime" in Minnesota. Unreal. All in all, a very "interesting" experience trying my first "Century". I'm already looking forward to trying (and finishing) others, in addition to trying this one again next year. Meanwhile, I spent about a couple of hours trying to clean the caked mud off of my bike and all of my clothes and think there will be remnants of that ride on my person and around the house for a long time in several hard to reach places.

Here are some pictures from my day Saturday and the following day Sunday at a couple of state parks that we hit on our way home (we are truly lucky to have so many great state parks here in MN):

How did the ride itself go you, ask? Well, I'll just leave you with a few pictures to give you sense, but let's just say the weather conditions (a raw, low 40's, driving, hellacious wind & rain and riding on mostly dirt and gravel and very, hilly, roads turned to mud) were less than ideal for such an endeavor.

So, I'll fess up that I fell about 20 miles short of finishing the full 100, finally bagging it with my buddy after about 80 miles (and piles of caked, clay-like mud all over us and our bikes) under our belts. Not finishing was initially a pretty big disappointment for me, considering how much I trained for, and looked forward to, the event, but I didn't feel quite so bad when I realized that many cyclists far more experienced than I bagged quite a bit earlier than we did, some at mile 30-40 or so at the first checkpoint. I'd be surprised if even half of the field of 700 or so finished, the conditions were truly that hellacious. The most unfortunate thing was not getting any pictures of the course and surrounding scenery itself (due to the horrendous weather), which was just gorgeous. Lots of scenic (and VERY green) rolling hills, alternating from woods and streams to open prairie and farmland. Very pretty.

Ah, gotta love "springtime" in Minnesota. Unreal. All in all, a very "interesting" experience trying my first "Century". I'm already looking forward to trying (and finishing) others, in addition to trying this one again next year. Meanwhile, I spent about a couple of hours trying to clean the caked mud off of my bike and all of my clothes and think there will be remnants of that ride on my person and around the house for a long time in several hard to reach places.

Here are some pictures from my day Saturday and the following day Sunday at a couple of state parks that we hit on our way home (we are truly lucky to have so many great state parks here in MN):

Saturday, May 14, 2011

May 14, 2011 Linkfest

Producer Inflation Rises in April on Commodities

"Widowmaker" oil trade lives up to its name, Is quant investing taking over commodity markets?

Trading Market Vectors Gold Miners ETF (GDX) vs SPDR Gold Shares (GLD)

Warning Signals From the Oil Inventory Report

Greenland Bets on Oil, Metals, Cows as Ticket to Independence

Impressive growth in US exports

The Fed and Asset Prices

Currency Hedge Fund Manager Taylor Says ‘Risk Rally’ Is Coming to an End

The difference between public and private stock markets

Facebook Busted in Clumsy Smear on Google

Labels:

linkfest

Friday, May 13, 2011

Wednesday, May 11, 2011

A Tripple Dip for Housing?

I came across this article yesterday and though I would share it with the group. It would appear that recent changes in insurance for jumbo mortgages might have a rather drastic affect on the housing market.

Federal Retreat on Bigger Loans Rattles Housing

MONTEREY, Calif. — By summer’s end, buyers and sellers in some of the country’s most upscale housing markets are slated to lose one their biggest benefactors: the deep pockets of the federal government. In this seaside community of pricey homes, the dread of yet another housing shock is already spreading.

We’re looking at more price drops, more foreclosures,” said Rick Del Pozzo, a loan broker. “This snowball that’s been rolling downhill is going to pick up some speed.”

For the last three years, federal agencies have backed new mortgages as large as $729,750 in desirable neighborhoods in high-cost states like California, New York, New Jersey, Connecticut and Massachusetts. Without the government covering the risk of default, many lenders would have refused to make the loans. With the economy in free fall, Congress broadened its traditionally generous support of housing to a substantial degree.

I hope the article was worth your time!

Federal Retreat on Bigger Loans Rattles Housing

MONTEREY, Calif. — By summer’s end, buyers and sellers in some of the country’s most upscale housing markets are slated to lose one their biggest benefactors: the deep pockets of the federal government. In this seaside community of pricey homes, the dread of yet another housing shock is already spreading.

We’re looking at more price drops, more foreclosures,” said Rick Del Pozzo, a loan broker. “This snowball that’s been rolling downhill is going to pick up some speed.”

For the last three years, federal agencies have backed new mortgages as large as $729,750 in desirable neighborhoods in high-cost states like California, New York, New Jersey, Connecticut and Massachusetts. Without the government covering the risk of default, many lenders would have refused to make the loans. With the economy in free fall, Congress broadened its traditionally generous support of housing to a substantial degree.

I hope the article was worth your time!

Research Website and Trading Considerations

In my quest to find untainted financial research to use as background for my continuing education efforts on the US and world’s economy, I have discovered, and would like to introduce a website:

http://mam.econoday.com

By introducing this website as a possible research location for each of us, I would also like to mention some data from this website, and potential trading philosophies which could logically be determined from this data.

The above website consists mainly of a calendar with links to financial reports and financial data, which may be read and assimilated by any student. Econoday also powers the Bloomberg calendar found at

http://www.bloomberg.com/markets/economic-calendar/,

which contains exactly the same data as the calendar on Econoday’s website, as well as a credit “powered by Econoday”.

Additionally, Econoday’s website contains reports which compile data from various (listed) sources, which have proven useful to me. Here is the location of a report compiled by Ann D. Picker, Chief Economist for Econoday, and is excellent reading for up-to-the-minute compilation of numerous international economic data:

http://mam.econoday.com/reports/rc/2011/Resource_Center/Archives/IP-Archive/05-09-11/index.html?cust=mam&year=2011

On the Econoday website I discovered a pointer to the NFIB’s optimism index, which I found interesting, and would like to mention in this post.

From the econoday.com website, “The small business optimism index is compiled from a survey that is conducted each month by the National Federation of Independent Business (NFIB) of its members. The index is a composite of ten seasonally adjusted components based on questions on the following: plans to increase employment, plans to make capital outlays, plans to increase inventories, expect economy to improve, expect real sales higher, current inventory, current job opening, expected credit conditions, now a good time to expand, and earnings trend. “

“The report notes the sample's hiring plans, which are limited, are not consistent with the solid payroll gains of the April employment report. This mismatch, according to the NFIB, suggests that the bulk of new hiring is happening in larger firms.” Here’s the data (for the preceeding month, ie January's data is for December):

Jan: 92.6

Feb: 94.1

Mar: 94.5

Apr: 91.9

May: 91.2

Looking at Ms. Picker’s report, and the NFIB data, one could logically conclude that we might consider not investing in (or shorting) smaller corporations in a particular sector, and “longing” the big ones. I have heard it mentioned on Bloomberg several times, how the big caps would be or are more successful, but there was never a justification for the comment, so I simply stored it for future investigation. Well, here’s the justification. Now the anomoly: the Russell 2000 has outperformed the S&P500. It may be when a correction does come, the Russell 2000 may correct further, but time will tell.

Anyway, I don’t think I would go out right now and start my own small business.

http://mam.econoday.com

By introducing this website as a possible research location for each of us, I would also like to mention some data from this website, and potential trading philosophies which could logically be determined from this data.

The above website consists mainly of a calendar with links to financial reports and financial data, which may be read and assimilated by any student. Econoday also powers the Bloomberg calendar found at

http://www.bloomberg.com/markets/economic-calendar/,

which contains exactly the same data as the calendar on Econoday’s website, as well as a credit “powered by Econoday”.

Additionally, Econoday’s website contains reports which compile data from various (listed) sources, which have proven useful to me. Here is the location of a report compiled by Ann D. Picker, Chief Economist for Econoday, and is excellent reading for up-to-the-minute compilation of numerous international economic data:

http://mam.econoday.com/reports/rc/2011/Resource_Center/Archives/IP-Archive/05-09-11/index.html?cust=mam&year=2011

On the Econoday website I discovered a pointer to the NFIB’s optimism index, which I found interesting, and would like to mention in this post.

From the econoday.com website, “The small business optimism index is compiled from a survey that is conducted each month by the National Federation of Independent Business (NFIB) of its members. The index is a composite of ten seasonally adjusted components based on questions on the following: plans to increase employment, plans to make capital outlays, plans to increase inventories, expect economy to improve, expect real sales higher, current inventory, current job opening, expected credit conditions, now a good time to expand, and earnings trend. “

“The report notes the sample's hiring plans, which are limited, are not consistent with the solid payroll gains of the April employment report. This mismatch, according to the NFIB, suggests that the bulk of new hiring is happening in larger firms.” Here’s the data (for the preceeding month, ie January's data is for December):

Jan: 92.6

Feb: 94.1

Mar: 94.5

Apr: 91.9

May: 91.2

Looking at Ms. Picker’s report, and the NFIB data, one could logically conclude that we might consider not investing in (or shorting) smaller corporations in a particular sector, and “longing” the big ones. I have heard it mentioned on Bloomberg several times, how the big caps would be or are more successful, but there was never a justification for the comment, so I simply stored it for future investigation. Well, here’s the justification. Now the anomoly: the Russell 2000 has outperformed the S&P500. It may be when a correction does come, the Russell 2000 may correct further, but time will tell.

Anyway, I don’t think I would go out right now and start my own small business.

Tuesday, May 10, 2011

Updating

Hello everybody.

I checked today the companies that I mentioned two weeks ago as short candidates (in case the market decides to reverse) as to how they were performing, I mean, is there weakness in price action? (from my astrological point of view), or are the holders getting a little nervous?

What I found is that DECK (probably the most wonderfull thing after sliced bread) showed a drop of 15% couple days after I mentioned it.Now is recovering, but is at midriver so to speak.Which means that could be a good one if it spikes past the top and when reaching a new high we have the stock market dropping, in that case there's a chance of a drop above average for her.

Regarding VRSN it crapped the bed too past week, and is trying to close the gap.Again, if the whole market drops this one looks certainly weak.

TXRH drop 8% show weakness all the way but snapped back in the last two days of the past week but couldn't pierce the price from April 26 and drop again today.

APKT is at the same levels that it was a couple weeks ago.Going up and down.I'm particularly interested in this one this coming Friday and Monday.Price action (if starts showing weakness) should tell me that maybe is ready to go down irregardless the main trend. Which is very important to me, meaning that is not linked to the main trend for a while in it's price action.

ACTG popped up came down an looks strongly horizontal.Is slightly above Apr 26.So with this one I'm not too convinced that can show excessive weakness in a turnaround.

COH is the only one that clearly didn't pay any attention to my post and decided to do it's own thing and went up 5% so I wouldn't consider it a candidate in case that a correction start gaining some traction.It looks solid so why mess with her?

Well will see what happens.Sold the SPPI puts that got the first week of April and keeping calls because maybe we reached a temporary bottom and can reverse.

I'll get some puts if she refuses to get up and fight in the next three days, as an insurance.

Around May 25 should be very exciting. Will see if it happens.

Dan

I checked today the companies that I mentioned two weeks ago as short candidates (in case the market decides to reverse) as to how they were performing, I mean, is there weakness in price action? (from my astrological point of view), or are the holders getting a little nervous?

What I found is that DECK (probably the most wonderfull thing after sliced bread) showed a drop of 15% couple days after I mentioned it.Now is recovering, but is at midriver so to speak.Which means that could be a good one if it spikes past the top and when reaching a new high we have the stock market dropping, in that case there's a chance of a drop above average for her.

Regarding VRSN it crapped the bed too past week, and is trying to close the gap.Again, if the whole market drops this one looks certainly weak.

TXRH drop 8% show weakness all the way but snapped back in the last two days of the past week but couldn't pierce the price from April 26 and drop again today.

APKT is at the same levels that it was a couple weeks ago.Going up and down.I'm particularly interested in this one this coming Friday and Monday.Price action (if starts showing weakness) should tell me that maybe is ready to go down irregardless the main trend. Which is very important to me, meaning that is not linked to the main trend for a while in it's price action.

ACTG popped up came down an looks strongly horizontal.Is slightly above Apr 26.So with this one I'm not too convinced that can show excessive weakness in a turnaround.

COH is the only one that clearly didn't pay any attention to my post and decided to do it's own thing and went up 5% so I wouldn't consider it a candidate in case that a correction start gaining some traction.It looks solid so why mess with her?

Well will see what happens.Sold the SPPI puts that got the first week of April and keeping calls because maybe we reached a temporary bottom and can reverse.

I'll get some puts if she refuses to get up and fight in the next three days, as an insurance.

Around May 25 should be very exciting. Will see if it happens.

Dan

Monday, May 9, 2011

Manny Mondays: Why are Irish Eyes Not Smiling at Tim Geithner?

Morning all! First of all, I hope all of the mothers out there had a very Happy Mother's Day yesterday. After yet another busy weekend (spring has finally sprung here in Minny, so it was a very active weekend mostly outdoors for me), one article that caught my eye late Sunday afternoon was the following most excellent Op-Ed by Morgan Kelly that appeared in the Irish Times on Saturday, 5/7:

Ireland's future depends on breaking free from bailout

One real eye-opener in the piece was the assertion that Ireland actually had a deal in place with the IMF for haircuts on their debt, but that Tim Geithner stepped in and killed it. Although not that surprising when you think about Geithner's continual policy of save the banks at all costs to all things Global Sheeple, it is still somewhat stunning to see it confirmed in such fashion. Here a few key excerpts from the Op-Ed:

Ireland’s Last Stand began less shambolically than you might expect. The IMF, which believes that lenders should pay for their stupidity before it has to reach into its pocket, presented the Irish with a plan to haircut €30 billion of unguaranteed bonds by two-thirds on average. Lenihan was overjoyed, according to a source who was there, telling the IMF team: “You are Ireland’s salvation.”

The deal was torpedoed from an unexpected direction. At a conference call with the G7 finance ministers, the haircut was vetoed by US treasury secretary Timothy Geithner who, as his payment of $13 billion from government-owned AIG to Goldman Sachs showed, believes that bankers take priority over taxpayers. The only one to speak up for the Irish was UK chancellor George Osborne, but Geithner, as always, got his way. An instructive, if painful, lesson in the extent of US soft power, and in who our friends really are.

The negotiations went downhill from there. On one side was the European Central Bank, unabashedly representing Ireland’s creditors and insisting on full repayment of bank bonds. On the other was the IMF, arguing that Irish taxpayers would be doing well to balance their government’s books, let alone repay the losses of private banks. And the Irish? On the side of the ECB, naturally.

In the circumstances, the ECB walked away with everything it wanted. The IMF were scathing of the Irish performance, with one staffer describing the eagerness of some Irish negotiators to side with the ECB as displaying strong elements of Stockholm Syndrome.

The bailout represents almost as much of a scandal for the IMF as it does for Ireland. The IMF found itself outmanoeuvred by ECB negotiators, their low opinion of whom they are not at pains to conceal. More importantly, the IMF was forced by the obduracy of Geithner and the spinelessness, or worse, of the Irish to lend their imprimatur, and €30 billion of their capital, to a deal that its negotiators privately admit will end in Irish bankruptcy. Lending to an insolvent state, which has no hope of reducing its debt enough to borrow in markets again, breaches the most fundamental rule of the IMF, and a heated debate continues there over the legality of the Irish deal.

Kelly further asserts that the main reason for onerous terms of Ireland's bailout was to send a message to Spain.......and frighten the Spanish into line with a vivid demonstration that EU rescues are not for the faint-hearted. And the ECB plan, so far anyway, has worked. Given a choice between being strung up like Ireland – an object of international ridicule, paying exorbitant rates on bailout funds, its government ministers answerable to a Hungarian university lecturer – or mending their ways, the Spanish have understandably chosen the latter.

But why was it necessary, or at least expedient, for the EU to force an economic collapse on Ireland to frighten Spain? The answer goes back to a fundamental, and potentially fatal, flaw in the design of the euro zone: the lack of any means of dealing with large, insolvent banks.

It's well worth reading the entire thing. The question that still lingers with me is just how long will the Global Sheeple continue to idly stand by while our so-called "leaders" throw us under bus, forcing us to accept having to sacrifice disproportionately more than our banking brethren in the name of "shared sacrifice", while bankers, who largely caused this debacle in the first place, are not only not being asked to sacrifice anything, but are back to raking in record pay (and in some cases more than they were making pre-bubble bursting) again, while everyone else limps along en masse?

Ireland's future depends on breaking free from bailout

One real eye-opener in the piece was the assertion that Ireland actually had a deal in place with the IMF for haircuts on their debt, but that Tim Geithner stepped in and killed it. Although not that surprising when you think about Geithner's continual policy of save the banks at all costs to all things Global Sheeple, it is still somewhat stunning to see it confirmed in such fashion. Here a few key excerpts from the Op-Ed:

Ireland’s Last Stand began less shambolically than you might expect. The IMF, which believes that lenders should pay for their stupidity before it has to reach into its pocket, presented the Irish with a plan to haircut €30 billion of unguaranteed bonds by two-thirds on average. Lenihan was overjoyed, according to a source who was there, telling the IMF team: “You are Ireland’s salvation.”

The deal was torpedoed from an unexpected direction. At a conference call with the G7 finance ministers, the haircut was vetoed by US treasury secretary Timothy Geithner who, as his payment of $13 billion from government-owned AIG to Goldman Sachs showed, believes that bankers take priority over taxpayers. The only one to speak up for the Irish was UK chancellor George Osborne, but Geithner, as always, got his way. An instructive, if painful, lesson in the extent of US soft power, and in who our friends really are.

The negotiations went downhill from there. On one side was the European Central Bank, unabashedly representing Ireland’s creditors and insisting on full repayment of bank bonds. On the other was the IMF, arguing that Irish taxpayers would be doing well to balance their government’s books, let alone repay the losses of private banks. And the Irish? On the side of the ECB, naturally.

In the circumstances, the ECB walked away with everything it wanted. The IMF were scathing of the Irish performance, with one staffer describing the eagerness of some Irish negotiators to side with the ECB as displaying strong elements of Stockholm Syndrome.

The bailout represents almost as much of a scandal for the IMF as it does for Ireland. The IMF found itself outmanoeuvred by ECB negotiators, their low opinion of whom they are not at pains to conceal. More importantly, the IMF was forced by the obduracy of Geithner and the spinelessness, or worse, of the Irish to lend their imprimatur, and €30 billion of their capital, to a deal that its negotiators privately admit will end in Irish bankruptcy. Lending to an insolvent state, which has no hope of reducing its debt enough to borrow in markets again, breaches the most fundamental rule of the IMF, and a heated debate continues there over the legality of the Irish deal.

Kelly further asserts that the main reason for onerous terms of Ireland's bailout was to send a message to Spain.......and frighten the Spanish into line with a vivid demonstration that EU rescues are not for the faint-hearted. And the ECB plan, so far anyway, has worked. Given a choice between being strung up like Ireland – an object of international ridicule, paying exorbitant rates on bailout funds, its government ministers answerable to a Hungarian university lecturer – or mending their ways, the Spanish have understandably chosen the latter.

But why was it necessary, or at least expedient, for the EU to force an economic collapse on Ireland to frighten Spain? The answer goes back to a fundamental, and potentially fatal, flaw in the design of the euro zone: the lack of any means of dealing with large, insolvent banks.

It's well worth reading the entire thing. The question that still lingers with me is just how long will the Global Sheeple continue to idly stand by while our so-called "leaders" throw us under bus, forcing us to accept having to sacrifice disproportionately more than our banking brethren in the name of "shared sacrifice", while bankers, who largely caused this debacle in the first place, are not only not being asked to sacrifice anything, but are back to raking in record pay (and in some cases more than they were making pre-bubble bursting) again, while everyone else limps along en masse?

Saturday, May 7, 2011

May 7, 2011 Linkfest

FT: Managing the eurozone’s fragility

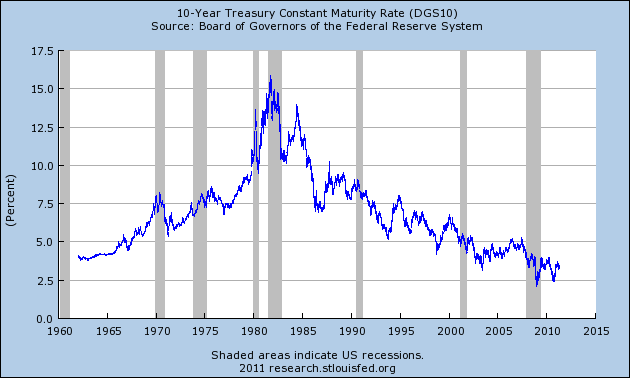

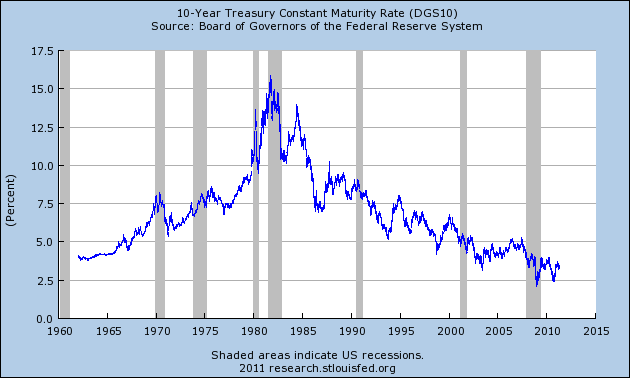

About that bubble in US Treasury bonds...

Could silver be the subprime of the commodity complex?

Social Darwinism

Divergences and Three Push Pattern Reversal in Crude Oil

Copper and the COT Report

Dr Copper falls through the ice

Glencore IPO marking the top?

Glencore IPO shows unregulated commodities traders eclipsing Goldman Sachs

Brazilian Banks Beat Wall Street as Itau Shows Who Rules

Brazils Stock Market Struggles

Demographic Destiny & The Next Secular Bull Market

US Youth Boom Bad News for Luxury Retailers. Wait, the Fourth Turning was right? Or just off by one?

The end of cheap: China’s tipping point

FT: China risks credit-fuelled Minsky moment. Credit still flowing.

China population turning-point to spur inflation:state economist

FT: Facebook hopes draw investors to Renren

Grouponomics

The Wall Street Journal Launches a WikiLeaks Competitor, SafeHouse. Breaking news: respected media institution vows to do journalism.

The Arms Race Against the Pirates

Hernando de Soto: The Destruction of Economic Facts. Perfect description of global financial markets.

About that bubble in US Treasury bonds...

Could silver be the subprime of the commodity complex?

Social Darwinism

Divergences and Three Push Pattern Reversal in Crude Oil

Copper and the COT Report

Dr Copper falls through the ice

Glencore IPO marking the top?

Glencore IPO shows unregulated commodities traders eclipsing Goldman Sachs

Brazilian Banks Beat Wall Street as Itau Shows Who Rules

Brazils Stock Market Struggles

Demographic Destiny & The Next Secular Bull Market

US Youth Boom Bad News for Luxury Retailers. Wait, the Fourth Turning was right? Or just off by one?

The end of cheap: China’s tipping point

FT: China risks credit-fuelled Minsky moment. Credit still flowing.

China population turning-point to spur inflation:state economist

FT: Facebook hopes draw investors to Renren

Grouponomics

The Wall Street Journal Launches a WikiLeaks Competitor, SafeHouse. Breaking news: respected media institution vows to do journalism.

The Arms Race Against the Pirates

Hernando de Soto: The Destruction of Economic Facts. Perfect description of global financial markets.

Labels:

linkfest

Friday, May 6, 2011

Friday Pot Pouri - What not to give Mom for Mother's Day Edition

The Absolute Worst Mother's Day Presents

What not to give Mom for Mother's Day

My Dad gave my mother a new toilet one year for her birthday.

Raccoons Invading Chicago's Lakefront

CHICAGO (CBS/WBBM) — Dark-eyed, wild bandits have invaded both the north and south lakefront, but officials are working to out-smart them.

As WBBM's Newsradio 780's Bernie Tafoya reports, the Chicago Park District tells says about 120 raccoons have been trapped between Belmont and Montrose harbors, as well as the harbors off Jackson Park.

"There's been some reports that they're living under docks and ransacking boats and being aggressive toward people. So obviously it's a public safety issue," Maxey-Faulkner tells the Chicago Sun-Times.

Photo Credit to Darkone

====================================================

I went to Costco Wednesday afternoon to pick up some last minute items before the weekend and to my amazement a tour bus was blocking the main drive in front of the store. Out of the bus came dozens of elderly Japanese people, cameras around their necks, not seeming to care that they were milling around between the bus and the entrance to the store so that no one with a cart could enter or leave. It was chaotic to say the least.

Cars were backing up down the aisles, people were getting frustrated, but the Japanese people had this look of sheer joy and anticipation, smiling, talking, but not moving very fast. Finally, they all managed to get into the store and they dispersed quickly. I spoke with the woman at the door who checks ID's and she said that tour buses were not that uncommon and the Japanese look for these things: vitamins, underwear & socks, snacks, cigarettes, and luggage while also sampling the food from the different carts. (my favorite past time as well)

And then they headed to the food court for some cheap, but tasty, American style lunch which is the highlight of their Costco shopping expedition according to the woman. Not sure how true this is, but the woman also told me that the Japanese do not have the variety of vitamins that we have in the states so they like to stock up and our prices are very good. It made my day to see how happy the normally reserved Japanese visitors were while shopping and eating samples and I am sure that Costco was more than happy for the business.

Contrast with my American tour group in New Zealand who couldn't wait to find the bar.

======================================================

Thursday, May 5, 2011

Manny Thorsday: Would a Temporary "Corporate Tax Holiday" on Overseas Profits Really Boost the U.S. Economy?

Morning all! With all of the recent wrangling over our current corporate tax rate being "too high", this article by Chuck Marr at the Center on Budget and Policy Priorities caught my eye over the weekend. Apparently the corporate lobbyists whores, I mean, hordes, are back at it again pushing for a temporary tax holiday for overeas corporate profits as a way to supposedly "stimulate the U.S. economy" and "create jobs" (in the U.S. I would presume?) despite overwhelming evidence to the contrary. Marr calls it a "battle of influence vs. evidence". Sadly, it seems we get a lot of that in this country this days with influence almost always coming out on top in blowout after blowout of epic proportions.

In the post, Marr takes a look at the last time such a tax holiday was passed, in 2004, and how that worked out for the U.S. economy and job creation fronts:

A similar tax holiday enacted in 2004 proved to be a complete policy failure. Its backers claimed that firms would use the repatriated earnings to invest in U.S. jobs and economic growth. Instead, they mostly used the money for purposes that the tax-holiday legislation had sought to prohibit, such as repurchasing their own stock and paying bigger dividends to their shareholders. Moreover, many firms actually laid off large numbers of U.S. workers even as they reaped multi-billion-dollar benefits from the tax holiday and passed them on to shareholders. To cite just two examples, Pfizer — which repatriated around $37 billion in foreign profits, the most of any firm — eliminated around 10,000 American jobs in 2005, while Merck repatriated $15.9 billion and announced layoffs of 7,000 workers in 2005. (These layoffs cannot be attributed to general economic weakness: they came at a time when the U.S. economy was growing significantly and adding jobs.)